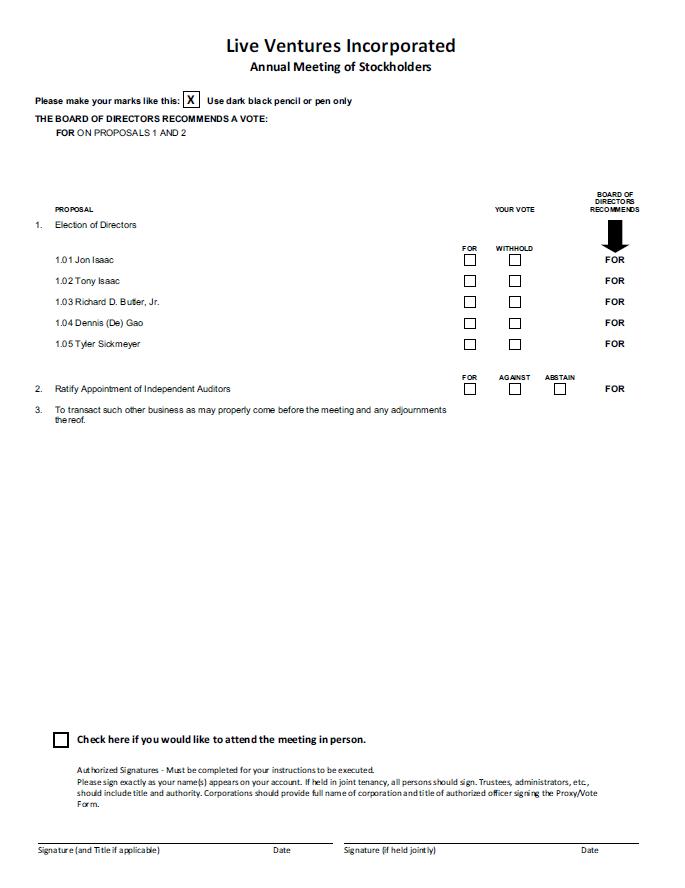

| 1. | To elect five directors to our Board of Directors;Directors. |

| 2. | | | 2. | To ratify the appointment of SingerLewak LLPWSRP LLC as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2018; and2021. |

| 3. | | | 3. | To transact such other business thatas may properly come before the meeting and any adjournments thereof. |

The Board of Directors has fixed the close of business on June 10, 2021 as the record date for the 2021 Annual Meeting. Only the holders of record of our common stock and Series B Convertible Preferred Stock as of record at the close of business on June 18, 2018the record date are entitled to receive notice of, and to vote at, the meeting or2021 Annual Meeting and any adjournment thereof. Note that weWe have also enclosed with this notice (i) our Annual Report on Form 10-K for the fiscal year ended September 30, 2017, as amended,2020 and (ii) a Proxy Statement. Your vote is extremely important to us. regardless of the number of shares you own. Whether you own a few shares or many, and whether or not you plan to attend the Annual Meeting in person, it is important that your shares be represented and voted at the meeting. Only holders of shares of our common stock and Series B Stock of record at the close of business on the record date are entitled to attend and vote at the Annual Meeting. You may vote your shares on the Internet, by telephone, or by completing, signing and promptly returning a proxy card, or you may voteby voting in person at the Annual Meeting. Voting online, by telephone, or by returning your proxy card does not deprive you of your right to attend the Annual Meeting. | By Order of the Board of Directors, | | | |

| | Jon Isaac | | President and Chief Executive Officer |

The proxy statement is dated June 22, 2021 and is first being made available to stockholders on or about June 22, 2021. Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on July 24, 2018:21, 2021: The Proxy Statement and Annual Report are available at www.proxydocs.com/LIVE.www.proxy.docs.com/LIVE. TABLE OF CONTENTS

TABLE OF CONTENTS i

Live Ventures Incorporated 325 EastE. Warm Springs Road, Suite 102 Las Vegas, Nevada 89119 (702) 939-0231 997-5961 PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 24, 2018 21, 2021 This Proxy Statement relates to the 20182021 Annual Meeting of Stockholders (the “Annual Meeting”) of Live Ventures Incorporated (“Live Ventures” or the “Company”). The Annual Meeting will be held on Tuesday,Wednesday, July 24, 201821, 2021 at 10:00 a.m. Pacific time, at our corporate offices located at 325 EastE. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119, or at such other time and place to which the Annual Meeting may be adjourned or postponed. The enclosed proxy is solicited by Live Ventures’ Board of Directors (the “Board”). The proxy materials relating to the Annual Meeting are first being mailed to stockholders entitled to vote at the Annual Meeting on or about June 25, 2018. 22, 2021. QUESTIONS AND ANSWERS ABOUT THE 2021 ANNUAL MEETING What is the purpose of the Annual Meeting?

Q: | What is the purpose of the Annual Meeting? |

A: | At the Annual Meeting, holders of shares of our common stock and Series B Convertible Preferred Stock (the “Series B Stock”) will act upon the matters outlined in the accompanying Notice of Annual Meeting and this Proxy Statement, including (i) the election of five directors to the Board and (ii) the ratification of the Audit Committee’s appointment of WSRP LLC (“WSRP”) as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2021. |

Q: | What are the Board’s recommendations? |

A: | The Board recommends a vote: |

FOR election of the nominated slate of directors; and FOR the ratification of the Audit Committee’s appointment of SingerLewak LLPWSRP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2018.2021. What are the Board’s recommendations?

The Board recommends a vote:

| · | FOR election of the nominated slate of directors; and |

| · | FOR the ratification of the Audit Committee’s appointment of SingerLewak LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2018. |

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion. Q: | Who is entitled to attend and vote at the Annual Meeting? Only holders of our common stock and Series B Stock of record at the close of business on the record date, June 18, 2018, or their duly appointed proxies, are entitled to receive notice of the Annual Meeting, attend the Annual Meeting and vote the shares that they held on that date at the Annual Meeting or any postponement or adjournment of the Annual Meeting. At the close of business on June 18, 2018, the record date, there were issued, outstanding and entitled to vote (i) 1,984,016 shares of our common stock, par value $0.001 per share, each of which is entitled to one vote and (ii) 214,244 shares of our Series B Stock, each of which is entitled to five votes per share.

A: | Only holders of shares of our common stock and Series B Stock of record at the close of business on the record date, June 10, 2021, or their duly appointed proxies, are entitled to receive notice of the Annual Meeting, attend the Annual Meeting and vote the shares that they held on that date at the Annual Meeting or any postponement or adjournment of the Annual Meeting. At the close of business on June 10, 2021, the record date, there were issued, outstanding and entitled to vote (i) 1,570,834 shares of our common stock, par value $0.001 per share, each of which is entitled to one vote, and (ii) 315,790 shares of our Series B Stock, each of which is entitled to five votes per share. |

Q: | How do I vote my shares if they are registered directly in my name? |

A: | We offer four methods for you to vote your shares at the Annual Meeting. While we offer four methods, we encourage you to vote through the Internet or by telephone, as they are the most cost-effective methods for the Company. We also recommend that you vote as soon as possible, even if you are planning to attend the Annual Meeting, so that the vote count will not be delayed. Both the Internet and the telephone provide convenient, cost-effective alternatives to returning your proxy card by mail. There is no charge to vote your shares via the Internet, though you may incur costs associated with electronic access, such as usage charges from Internet access providers. If you choose to vote your shares through the Internet or by telephone, there is no need for you to mail your proxy card. |

1 How do I vote my shares if they are registered directly in my name?

We offer four methods for you to vote your shares at the annual meeting.While we offer four methods, we encourage you to vote through the Internet or by telephone, as they are the most cost-effective methods for the Company.We also recommend that you vote as soon as possible, even if you are planning to attend the annual meeting, so that the vote count will not be delayed. Both the Internet and the telephone provide convenient, cost-effective alternatives to returning your proxy card by mail. There is no charge to vote your shares via the Internet, though you may incur costs associated with electronic access, such as usage charges from Internet access providers. If you choose to vote your shares through the Internet or by telephone, there is no need for you to mail your proxy card.

You may (i) vote in person at the annual meeting or (ii) authorize the persons named as proxies on the enclosed proxy card, Jon Isaac and Virland A. Johnson, to vote your shares by returning the enclosed proxy card by mail, through the Internet or by telephone. | · | By Internet: Go to www.proxypush.com/LIVE. Have your proxy card available when you access the web site. You will need the control number from your proxy card to vote.By telephone: Call (866) 390-5229 toll-free (in the United States, U.S. territories, and Canada) on a touch-tone telephone. Have your proxy card available when you call. You will need the control number from your proxy card to vote. If you wish to participate in cumulative voting, you must use one of the other three methods of voting (in person at the annual meeting, by Internet or by mail). By mail: Complete, sign and date the proxy card, and return it in the postage paid envelope provided with the proxy material. Q: | How do I vote my shares if they are held in the name of my broker (street name)? |

A: | If your shares of common stock or Series B Stock are held by your broker, bank or other nominee, or its agent (“Broker”) in “street name,” you will receive a voting instruction form from your proxy cardBroker asking you how your shares should be voted. You should contact your Broker with questions about how to vote.provide or revoke your instructions. |

| · | By telephone: Call (866) 390-5229 toll-free (in the United States, U.S. territories and Canada) on a touch-tone telephone. Have your proxy card available when you call. You will need the control number from your proxy card to vote. Cumulative voting cannot be accepted by telephone. If you wish to participate in cumulative voting, you must use one of the other three methods of voting (in person at the annual meeting, by Internet or by mail). |

| · | By mail: Complete, sign and date the proxy card, and return it in the postage paid envelope provided with the proxy material. |

How do I vote my shares if they are held in the name of my broker (street name)?

If your shares of common stock or Series B Stock are held by your broker, bank or other nominee, or its agent (“Broker”) in “street name,” you will receive a voting instruction form from your Broker asking you how your shares should be voted. You should contact your Broker with questions about how to provide or revoke your instructions.

If you hold your shares in “street name” and do not provide specific voting instructions to your Broker, a “broker non-vote” will result with respect to Proposal 1. Therefore, it is very important to respond to your Broker’s request for voting instructions on a timely basis if you want your shares held in “street name” to be represented and voted at the Annual Meeting. Please see below for additional information if you hold your shares in “street name” and desire to attend the Annual Meeting and vote your shares in person. What if I vote and then change my mind?

If you are a stockholder of record, you may revoke your proxy at any time before it is exercised by either (i) filing with our Corporate Secretary a notice of revocation; (ii) sending in another duly executed proxy bearing a later date; or (iii) attending the meeting and casting your vote in person. Your last vote will be the vote that is counted.

Q: | What if I vote and then change my mind? |

A: | If you are a stockholder of record, you may revoke your proxy at any time before it is exercised by either (i) filing with our Corporate Secretary a notice of revocation; (ii) sending in another duly executed proxy bearing a later date; or (iii) attending the meeting and casting your vote in person. Your last vote will be the vote that is counted. |

If you hold your shares in “street name,” refer to the voting instructing form provided by your Broker for more information about what to do if you submit voting instructions and then change your mind in advance of the Annual Meeting. Q: | How can I get more information about attending the Annual Meeting and voting in person? The Annual Meeting will be held on Tuesday, July 24, 2018 at 10:00 a.m. Pacific time, at our corporate offices located at 325 East Warm Springs Road, Suite 102, Las Vegas, Nevada 89119, or at such other time and place to which the Annual Meeting may be adjourned or postponed. For additional details about the Annual Meeting, including directions to the Annual Meeting and information about how you may vote in person if you so desire, please contact Live Ventures at (702) 997-5968.

A: | The Annual Meeting will be held on Wednesday, July 21, 2021 at 10:00 a.m. Pacific time, at our principal executive offices located at 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119, or at such other time and place to which the Annual Meeting may be adjourned or postponed. For additional details about the Annual Meeting, including directions to the Annual Meeting and information about how you may vote in person if you so desire, please contact Live Ventures at (702) 997-5968. |

If you hold your shares in “street name,” please bring an account statement or letter from the applicable Broker, indicating that you are the beneficial owner of the shares as of the record date if you would like to gain admission to the Annual Meeting. In addition, if you hold your shares in “street name” and desire to actually vote your shares in person at the Annual Meeting, you must obtain a valid proxy from your Broker. For more information about obtaining such a proxy, contact your Broker. Q: | What constitutes a quorum? |

A: | The presence at the Annual Meeting, in person or by proxy, of the holders of not less than a majority of the shares entitled to vote on the record date, present in person or by proxy, will constitute a quorum, permitting |

2

| us to conduct our business at the Annual Meeting. Proxies received but marked as abstentions will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining whether a quorum is present. Broker non-votes will also be counted for purposes of determining whether a quorum is present. |

Q: | What vote is required to approve each item? |

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares entitled to vote on the record date will constitute a quorum, permitting us to conduct our business at the Annual Meeting. Proxies received but marked as abstentions will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining whether a quorum is present. Broker non-votes will also be counted for purposes of determining whether a quorum is present.

What vote is required to approve each item?

Election of Directors. Election of a director requires the affirmative vote of the holders of a plurality of the shares for which votes are cast at a meeting at which a quorum is present. The five persons receiving the greatest number of votes will be elected as directors. Since only affirmative votes count for this purpose, a properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. Stockholders may not cumulate votes in the election of directors. Pursuant to rules approved by the Securities and Exchange Commission (the “SEC”) brokers are not entitled to use their discretion to vote uninstructed proxies in, among other things, uncontested director elections. In other words, if your shares are held by your broker in “street name” and you do not provide your broker with instructions about how your shares should be voted in connection with this proposal, your shares will not be voted and a “broker non-vote” will result.Therefore, if you desire that your shares be voted in connection with the election of the Board, it is imperative that you provide your broker with voting instructions.If your shares are held by your broker in “street name,” you will receive a voting instruction form from your broker or the broker’s agent asking you how your shares should be voted. Please complete the form and return it in the envelope provided by the broker or agent.

Ratification of Auditors. The ratification of the Audit Committee’s appointment of SingerLewak LLPWSRP as our independent registered public accounting firm for the fiscal year ending September 30, 20182021 will be approved if athe proposal receives the affirmative vote of the majority of the votes castshares entitled to vote at the Annual Meeting, are votedpresent in person or by proxy, in favor of the proposal. A properly executed proxy marked “ABSTAIN” Q: | Are abstentions and broker non-votes counted in the vote totals? |

A: | A broker non-vote occurs when shares held by a Broker are not voted with respect to a particular proposal because the Broker does not have discretionary authority to vote on the matter and has not received voting instructions from its clients. If your Broker holds your shares in its name and you do not instruct your Broker how to vote, your Broker will only have discretion to vote your shares on “routine” matters. Where a proposal is not “routine,” a Broker who has received no instructions from its clients does not have discretion to vote its clients’ uninstructed shares on that proposal. At our 2021 Annual Meeting, only Proposal 2 (ratifying the appointment of our independent registered public accounting firm) is considered a routine matter. Your Broker will therefore not have discretion to vote on the election of directors as this proposal is a “non-routine” matter. |

Broker non-votes and abstentions by stockholders from voting (including Brokers holding their clients’ shares of record who cause abstentions to such matterbe recorded) will be counted towards determining whether or not a quorum is present. However, as the five nominees receiving the highest number of affirmative votes will be voted or treated as a vote cast. Accordingly, an abstentionelected, abstentions and broker non-votes will not affect the outcome of this proposal. Brokers are entitled to use their discretion to vote uninstructed proxies with respectthe election of directors. With regard to the ratification of our independent auditors. Can I dissent or exercise rights of appraisal?

Under Nevada law, holders of our common stock are not entitled to dissenters’ rights in connection with anyaffirmative vote of the proposals to be presentedshares present at the Annual Meeting or to demand appraisal of their shares asmeeting required for Proposal 2, it is a result of the approval of any of the proposals.

Who pays for this proxy solicitation?

The Company will bear the entire cost of this proxy solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy card and any additional solicitation materials furnished to the stockholders. Copies of solicitation materialsroutine matter so there will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forwardno broker non-votes, but abstentions will have the solicitation material to such beneficial owners.

Where can I access this Proxy Statement and the related materials online?

The Proxy Statement and our Annual Report to Stockholders are available at http://www.proxydocs.com/LIVE.

effect of a vote against Proposal 2. Q: | 4 | Can I dissent or exercise rights of appraisal? |

A: | Under Nevada law, neither holders of our common stock nor holders of our Series B Stock are entitled to dissenters’ rights in connection with any of the proposals to be presented at the Annual Meeting or to demand appraisal of their shares as a result of the approval of any of the proposals. |

Q: | Who pays for this proxy solicitation? |

A: | The Company will bear the entire cost of this proxy solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy card, and any additional solicitation materials furnished to the stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward the solicitation material to such beneficial owners. |

Q: | Where can I access this Proxy Statement and the related materials online? |

A: | The Proxy Statement and our Annual Report to Stockholders are available at http://www.proxydocs.com/LIVE. |

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIALBENEFICIAL OWNERS AND MANAGEMENT The following table sets forth certain information regardingwith respect to the beneficial ownership of our common stock and Series B Stock as of June 1, 2018 of (i) 10, 2021, the record date, for: each executive officer and each director of our Company; (ii) named executive officers; each of our current directors; all of our current executive officers and directors of our Company as a group; and (iii) each person known to the Companyus to be the beneficial owner of more than 5% of either our common stock or Series B Stock. The business address of each beneficial owner listed in the table unless otherwise noted is c/o Live Ventures Incorporated, 325 E. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119. We deem shares of our common stock and Series B Stock that may be acquired by an individual or group within 60 days of June 1, 2018,10, 2021, pursuant to the exercise of options or warrants or conversion of convertible securities, to be outstanding for the purpose of computing the percentage ownership of such individual or group, but these shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person or group shown in the table. Percentage of ownership is based on 1,860,0591,570,834 shares of common stock and 214,244315,790 shares of Series B Stock (which convert into 1,578,950 shares of common stock) outstanding on June 1, 2018. 10, 2021. The holders of shares of the Series B Stock have agreed not to sell transfer, assign, hypothecate, pledge, margin, hedge, trade, or otherwise obtain or attempt to obtain any economic value from any of such shares or any shares into which they may be converted (e.g., common stock) or for which they may be exchanged. This “lockup” agreement expires on December 31, 2021. The information as to beneficial ownership was either (i) furnished to us by or on behalf of the persons named or (ii) determined based on a review of the beneficial owners’ Schedules 13D/G and Section 16 filings with respect to our common stock. Unless otherwise indicated, the business address of each person listed is 325 East Warm Springs Road, Suite 102, Las Vegas, Nevada 89119.stock and Series B Stock. | Name of Beneficial Owner | | Amount and

Nature of

Beneficial

Ownership (Common Stock Unless Otherwise Noted) | | | Percentage

of Class | | | | | | | | | | | Executive Officers and Directors: | | | | | | | | | | Jon Isaac (1) | | | 1,526,536 | | | | 58.1 | % | | Tony Isaac (2) | | | 75,000 | | | | 3.7 | % | | Richard D. Butler, Jr. | | | 15,478 | | | | * | | | Dennis (De) Gao | | | 12,671 | | | | * | | | Tyler Sickmeyer | | | – | | | | * | | | Timothy Bailey | | | – | | | | * | | | Rodney Spriggs (3) | | | 4,167 | | | | * | | | All Executive Officers and Directors as a group (9 persons) | | | 1,641,852 | | | | 60.5 | % | | | | | | | | | | | | Other 5% Stockholders: | | | | | | | | | Isaac Capital Group, LLC (4)

3525 Del Mar Heights Rd. Suite 765

San Diego, California 92130 | | | 1,381,905 | | | | 54.2 | % |

_________________________

*Represents less than 1% of our issued and outstanding common stock.

Name of Beneficial Owner | | Amount and Nature of Beneficial Ownership (Common Stock Unless Otherwise Noted) | | | Percentage of Class | | Executive Officers and Directors: | | | | | | | | | Jon Isaac, President and Chief Executive Officer of Live Ventures Incorporated (1) | | | 1,538,187 | | | | 53.1 | % | Weston A. Godfrey, Jr., Chief Executive Officer of Marquis Industries, Inc. | | | — | | | | — | | Michael J. Stein, Senior Vice President and General Counsel (2) | | | 12,000 | | | * | | Tony Isaac, Director | | | 55,000 | | | | 3.4 | % | Richard D. Butler, Jr., Director | | | 15,487 | | | * | | Dennis (De) Gao, Director | | | — | | | * | | Tyler Sickmeyer, Director | | | — | | | | — | | All Executive Officers and Directors as a group (11 persons) | | | 1,653,342 | | | | 56.1 | % | | | | | | | | | | Other 5% Stockholders: | | | | | | | | | Isaac Capital Group, LLC (3) 505 E Windmill Ln, Suite 1C-231, Las Vegas, NV 89123 San Diego, California 92130 | | | 1,299,510 | | | | 45.3 | % | Kingston Diversified Holdings LLC (4) 505 E Windmill Ln, Suite 1C-231, Las Vegas, NV 89123 | | | 279,440 | | | | 15.1 | % |

(1)* | Includes 158,356Represents less than 1% of our issued and outstanding common stock. |

(1) | Isaac Capital Group LLC (“ICG”) owns 259,902 shares of Series B Preferred Stock that are convertible into 791,7801,299,510 shares of common stock owned by Isaac Capital Group, LLC (“ICG”), of whichstock. Jon Isaac is the President and sole member of ICG and accordingly has sole voting and dispositive power with respect to such shares. Also includes warrantsICG beneficially owns 45.3% of the Company’s |

4

| outstanding capital stock. The holders of shares of the Series B Stock have agreed not to purchase 590,146 additionalsell transfer, assign, hypothecate, pledge, margin, hedge, trade, or otherwise obtain or attempt to obtain any economic value from any of such shares or any shares into which they may be converted (e.g., common stock) or for which they may be exchanged. This “lockup” agreement expires on December 31, 2021. Jon Isaac owns 213,677 shares of common stock at exercise prices ranging from $3.32 to $5.70 per share held by ICG. Jon Isaac owns 69,631 shares of common stock. In addition, Jon Isaacand holds options to purchase up to 75,000 shares of common stock at exercise prices ranging from $5.00 to $10.00 per share, all of which are fully vested and exercisable. | | | (2) | Includes options to purchase 75,00025,000 shares of common stock at an exercise price of $15.18.$10.00 per share, all of which are currently exercisable. |

(2) | | (3) | Includes options to purchase 4,16712,000 shares of common stock at an exercise price of $10.86$11.80 per share. |

(3) | | (4) | Includes 158,356259,902 shares of Series B Preferred Stock that are convertible into 791,7801,299,510 shares of common stock owned by ICG. Also includes warrants to purchase 590,146 additionalThe holders of shares of the Series B Stock have agreed not to sell transfer, assign, hypothecate, pledge, margin, hedge, trade, or otherwise obtain or attempt to obtain any economic value from any of such shares or any shares into which they may be converted (e.g., common stock at exercise prices ranging from $3.32 to $5.70 per share held by ICG. ICG converted the 791,759 shares of common stock to 158,333stock) or for which they may be exchanged. This “lockup” agreement expires on December 31, 2021. |

(4) | Includes 55,888 shares of Series B Preferred Convertible Stock and the warrants to purchase of 590,146 shares to 118,029 shares the Series B Preferred Convertible Stock. The Series B Preferred Convertible Stock and the underlyingthat are convertible into 279,440 shares of common stock (791,780 and 590,146 warrant shares) are subjectowned by ICG. The holders of shares of the Series B Stock have agreed not to a lock-upsell transfer, assign, hypothecate, pledge, margin, hedge, trade, or otherwise obtain or attempt to obtain any economic value from any of such shares or any shares into which they may be converted (e.g., common stock) or for which they may be exchanged. This “lockup” agreement with the issuer that expires on December 31, 2021. |

ELECTION OF DIRECTORS

(Proposal No. 1) General Live Ventures’ Amended and Restated Bylaws provide that the Board shall consist of not less than three nor more than nine directors (with the precise number of directors to be established by resolution of the Board), each of whom is elected annually. Currently, there are five members of the Board. The Board has determined that five directors will be elected at the 20182021 Annual Meeting and has nominated each of the five incumbent directors for re-election. Each director is to be elected to hold office until the next annual meeting of stockholders or until his successor is elected and qualified. If a director resigns or otherwise is unable to complete his term of office, the Board may elect another director for the remainder of the departing director’s term. The Board has no reason to believe that the nominees will not serve if elected, but if they should become unavailable to serve as a director, and if the Board designates a substitute nominee, the persons named as proxies will vote for the substitute nominee designated by the Board. Recommendation of our Board of Directors The Board recommends voting "FOR" the election of each of the Director nominees as directors, each of whom shall hold office for a term of one year, expiring at the Annual Meeting in 2022, and until his successor is elected and qualified, or until his earlier death, resignation or removal. Vote Required If a quorum is present at the Annual Meeting, the five nominees receiving the highest number of votes will be elected to the Board. Nominees for Election to the Board of Directors in 2018 2021 The Board’s nominees are listed below. The Board recommends that you vote FOR the election of each of Messrs. Jon Isaac, Tony Isaac, Butler, Gao, and Sickmeyer. Jon Isaac, 35 38 | Mr. Jon Isaac has served as a director of our Company since December 2011 and became our President, Chief Executive Officer and Chief Financial Officer in January 2012. He is the founder of Isaac Organization, a privately held investment company. At Isaac Organization, Mr. Isaac has closed a variety of multi-faceted real estate deals and has experience in aiding public companies to implement turnarounds and in raising capital. Mr. Isaac studied Economics and Finance at the University of Ottawa, Canada. |

| Specific Qualifications: | | • | Qualifications: ☐Relevant educational background and business experience. | | • | ☐Experience in aiding public companies to implement turnarounds and in raising capital. |

5

| Tony Isaac, 63 66 | Mr. Tony Isaac has served as a director of our Company since December 2011 and began serving as the Company’s Financial Planning and Strategist/Economist in July 2012. Mr. Isaac’s specialty is egotiationnegotiation and problem-solving of complex real estate and business transactions. Mr. Isaac graduated from Ottawa University in 1981, where he majored in Commerce and Business Administration and Economics. |

| Specific Qualifications: | | • | Qualifications: ☐Relevant educational background and business experience. | | • | ☐Experience in negotiation and problem-solving of complex real estate and business transactions. |

| Richard D. Butler, Jr., 6872* Audit Committee Member Compensation Committee Chairman Corporate Governance and Nominating Committee Chairman | Mr. Butler is Chairman of the Corporate Governance and Nominating Committee and the Compensation Committee and has served as a director and member of the Audit Committee of our Company since August 2006 (including YP.com from 2006-2007). He is a veteran savings and loan and mortgage banking executive, co-founder and major shareholder of Aspen Healthcare, Inc. and Ref-Razzer Corporation, former Chief Executive Officer of Mt. Whitney Savings Bank, Chief Executive Officer of First Federal Mortgage Bank, Chief Executive Officer of Trafalgar Mortgage, and Executive Officer & Member of the President’s Advisory Committee at State Savings & Loan Association (peak assets $14 billion) and American Savings & Loan Association (NYSE: FCA; peak assets $34 billion). Mr. Butler attended Bowling Green University in Ohio, San Joaquin Delta College in California and Southern Oregon State College. | | | |

| Specific Qualifications: | | • | ☐Relevant educational background and business experience. | | • | ☐Extensive experience as Chief Executive Officer for several companies in the banking and finance industries. | | • | ☐Experience as a public company director. | | • | ☐Experience in workouts and restructurings, mergers, acquisitions, business development, and sales and marketing. | | • | ☐Background and experience in finance required for service on Audit Committee. |

| | Dennis (De) Gao, 3841* Audit Committee Chairman

Compensation Committee Member

Corporate Governance and Nominating Committee Member | Mr. Gao is the Chairman of the Audit Committee and has served as a director of our Company since January 2012. In July 2010, Mr. Gao co-founded and became the CFO at Oxstones Capital Management, a privately held company and a social and philanthropic enterprise, serving as an idea exchange for the global community. Prior to establishing Oxstones Capital Management, from June 2008 until July 2010, Mr. Gao was a product owner at Procter and Gamble for its consolidation system and was responsible for the Procter and Gamble’s financial report consolidation process. From May 2007 to May 2008, Mr. Gao was a financial analyst at the Internal Revenue Service's CFO division. Mr. Gao has a dual major Bachelor of Science degree in Computer Science and Economics from University of Maryland, and an M.B.A. specializing in finance and accounting from Georgetown University’s McDonough School of Business. |

| Specific Qualifications: | | • | | Specific Qualifications: ☐Relevant educational background and business experience. | | • | ☐Background and experience in finance required for service on Audit Committee. | | • | ☐Experience having ultimate responsibility for the preparation and presentation of financial statements. | | • | “Audit☐ “Audit Committee Financial Expert” for purposes of SEC rules and regulations. |

6

| Tyler Sickmeyer, 3235* Audit Committee Member Compensation Committee Member

Corporate Governance and Nominating Committee

Member | Mr. Sickmeyerhas served as a director of our Company and as a member of the Audit Committee since August 11, 2014. In August 2008, Mr. Sickmeyer founded and since that time has served as the CEO of Fidelitas Development, a full-service marketing firm that focuses on producing an improved return on investment rate for its clients. Mr. Sickmeyer, an eCommerce thought expert who has presented to audiences across the globe, has provided consulting services to a variety of companies, large and small alike, and specializes in creating efficiencies for developing brands. Mr. Sickmeyer studied business at Robert Morris University and Lincoln Christian University. |

| Specific Qualifications: | | • | | Specific Qualifications: ☐Over a decade15 years of experience in marketing, including promotion and brand development through the use of social media marketing. |

* Independent director. Certain Family Relationships Jon Isaac, who is a director and serves as our President and Chief Executive Officer, is the son of Tony Isaac, who is also a director and serves as our Financial Planning and Strategist/Economist. Tony Isaac does not receive any compensation from the Company other than compensation paid to the independent members of the Board. Involvement in Certain Legal Proceedings To the best of our knowledge, there have been no events under any bankruptcy act, no criminal proceedings and no judgments, injunctions, orders, or decrees material to the evaluation of the ability and integrity of any director during the past ten years.years other than the filing by ApplianceSmart, Inc., of a voluntary petition in the United States Bankruptcy Court for the Southern District of New York seeking relief under Chapter 11 of Title 11 of the United States Code. EXECUTIVE OFFICERS Set forth below is certain information regarding each of our current executive officers as of June 1, 2018,10, 2021, other than Jon Isaac, whose biographical information is presented under “Nominees for Election to the Board of Directors in 2018.2021.” | | | | Weston A. Godfrey, Jr., 42 | Mr. Godfrey became Chief Executive Officer of Marquis Industries, Inc. on July 1, 2018 after re-joining the company as Executive Vice President on January 22, 2018. Mr. Godfrey served as Sales Operations Manager and Senior Sales Manager for Samsung Electronics America, Inc for three years prior to re-joining the company, where he was responsible for financial operations, forecasting and sales in the Home Appliance business. Prior to joining Samsung Electronics America, Inc, Mr. Godfrey spent five years serving as Vice President of Operations for Marquis Industries, Inc reporting directly to the Chief Executive Officer and responsible for credit, claims, customer service, sales operations, supply chain, and purchasing. Early on in his career, Mr. Godfrey worked for Dupont’s nylon fibers business where he was certified as a Six Sigma Black Belt. Mr. Godfrey’s experience includes process improvement, supply chain optimization, demand planning, forecasting, business operations, strategic selling and strategic purchasing. Mr. Godfrey holds a Bachelor of Business Administration in Marketing from the University of Georgia. |

7

| | Rodney Spriggs, 54 | Mr. Spriggs is President and CEO of Vintage Stock. Mr. Spriggs joined Vintage Stock as General Manager in January 1990 and has served as President of Vintage Stock since 2002 and President of Moving Trading Company since 2006. He received a Bachelor’s degree in Business Administration and a minor in marketing from Missouri Southern State University. Mr. Spriggs has also been a partner and advisor in a commercial LED lighting and commercial and resident solar company. In addition to corporate oversight, Mr. Spriggs is responsible for new market openings, the specialty retail site selection, lease negotiation and product acquisitions. | | | Thomas Sedlak, 50 | Mr. Sedlak was appointed the Chief Executive Officer of Precision on July 14, 2020 in connection with the Company’s acquisition of Precision Industries, Inc. (“Precision Marshall”). Prior to his appointment as Chief Executive Officer, Mr. Sedlak was Senior Vice President of Precision Marshall. Mr. Sedlak joined Precision Marshall in 2008 as the Controller and was promoted to Manager of Operations in October 2008. In January 2013, Mr. Sedlak was promoted to Vice President of Operations and, in November 2017, Mr. Sedlak was promoted to Senior Vice President. Prior to joining Precision Marshall, Mr. Sedlak had more than 11 years of financial management and controllership experience with PPG Industries and DQE Energy Services. Mr. Sedlak holds a Bachelor’s degree from Robert Morris University and Master of Business Administration from the University of Pittsburgh – Joseph M. Katz Graduate School of Business. | | | Virland A. Johnson, 5760 | Mr. Johnson became ourjoined the Company as Chief Financial Officer on January 3, 2017. Mr. Johnson joined the Company in November 2016 as a consultant. Mr. Johnson was Sr. Director of Revenue for JDA Software for six years prior to joining the Company, where he was responsible for revenue recognition determination, sales and contract support while acting as a subject matter expert. Prior to joining JDA, Mr. Johnson provided leadership and strategic direction while serving in C-Level executive roles in public and privately held companies such as Cultural Experiences Abroad, Inc., Fender Musical Instruments Corp., Triumph Group, Inc., Unitech Industries, Inc. and Younger Brothers Group, Inc. Mr. Johnson’s more than 25 years of experience is primarily in the areas of process improvement, complex debt financings, SEC and financial reporting, turn-arounds, corporate restructuring, global finance, merger and acquisitions and returning companies to profitability and enhancing shareholder value. Early on in his career, Mr. Johnson worked in public accounting while attending Arizona State University. Mr. Johnson holds a Bachelor’s degree in Accountancy from Arizona State University, and is a licensed Certified Public Accountant in Arizona.University. | | | Tim Bailey, 70Eric Althofer, 38 | Mr. Bailey is CEOAlthofer joined the Company as Chief Operating Officer and Managing Director (Finance) on April 10, 2021. Prior to joining Live Ventures, Mr. Alhofer served as a director of Marquis.Capitala Investment Advisors (“Capitala”), joining the firm in 2014. Mr. Bailey has 46Althofer’s primary responsibilities included transaction screening, structuring and due diligence execution. Prior to joining Capitala, Mr. Althofer spent more than three years of leadership experiencein investment banking with Jefferies LLC, working on over 25 M&A, debt and equity transactions for consumer and retail companies. Before joining Jefferies, Mr. Althofer worked as a strategy and operations consultant for four years with Deloitte Consulting where he worked primarily in the floorcovering industry, including 23 years with Marquis Industries.healthcare and financial services industries. Mr. Bailey holds a CPA license and spent the first 17 years of his careerAlthofer graduated cum laude from Washington University in a carpet industry-focused public accounting firm. In 1988, he left public accounting to become a shareholder and Executive VP / CFO of Grassmore, Inc., which manufactured grass carpet. Mr. Bailey installed the internal financial controls and helped Grassmore grow and oversaw its successful sale to Beaulieu of America in 1992. Mr. Bailey consulted with Beaulieu for two years before acquiring Marquis Industries in 1994. Marquis was small and struggling at the time of Mr. Bailey’s acquisition. He was able to build a strong leadership team and turn the company into a top 10 residential carpet manufacturer in the USSt. Louis with a diversified product linedegree in Economics and received his M.B.A., with distinction, from the University of softMichigan Ross School of Business with emphases in Finance and hard surfaces for the residential and commercial markets.Accounting. | | | Rodney Spriggs, 51 | Mr. Spriggs is President and CEO of Vintage Stock. Mr. Spriggs joined Vintage Stock as General Manager in January 1990 and has served as President of Vintage Stock since 2002 and President of Moving Trading Company since 2006. He received a Bachelor’s degree in Business Administration and a minor in marketing from Missouri Southern State University. Mr. Spriggs gained experience in the specialty retail business by selling baseball and other sports cards in his own retail store to pay his way through college. In addition to corporate oversight, Mr. Spriggs is responsible for new market openings, the specialty retail site selection, lease negotiation and product acquisitions. | | | Michael J. Stein, 44 47 | Mr. Stein joined the Company as Senior Vice President and General Counsel in October 2017. Prior to joining Live Ventures, Mr. Stein most recently served aswas a corporate partner at the law firm of DLA Piper, LLP (US) where, sincefrom April 2016 through October 2017 and, as an associate from April 2005 through June 2012, he advised public and private companies on corporate governance matters, debt and equity securities offerings (including several initial public offerings), and merger and acquisition transactions. Prior to rejoining DLA Piper in April 2016, Mr. Stein served as Associate Chief Counsel – Transactional at Caesars Entertainment Corporation (NASDAQ: CZR), and Senior Vice President, Deputy General Counsel at Everi Holdings Inc. (NYSE: EVRI). Mr. Stein holds a Juris Doctor from the University of Maryland and Bachelor’s and Master’s degrees in Accounting from the University of Florida. |

8

CORPORATE GOVERNANCE How often did the Board meet during fiscal 2017? 2021? The Board met seven times during fiscal 2017,2021, either telephonically or in person.person, and took action by unanimous written consent three times. None of our directors attended fewer than 75% of the meetings of the Board held during the director’s service or of any committee on which the director served during fiscal 2017. 2021. Who are the Board’s “independent” directors? Each year, the Board of Directors reviews the relationships that each director has with the Company and with other parties. Only those directors who do not have any of the categorical relationships that preclude them from being independent within the meaning of applicable NASDAQNasdaq Listing Rules and who the Board of Directors affirmatively determines have no relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, are considered to be independent directors. The Board of Directors has reviewed a number of factors to evaluate the independence of each of its members. These factors include its members’ current and historic relationships with the Company and its competitors, suppliers, and customers; their relationships with management and other directors; the relationships their current and former employers have with the Company; and the relationships between the Company and other companies of which a member of the Company’s Board of Directors is a director or executive officer. After evaluating these factors, the Board of Directors has determined that a majority of the members of the Board, of Directors, namely Messrs. Butler, Gao, and Sickmeyer, do not have any relationships that would interfere with the exercise of independent judgment in carrying out their responsibilities as directors and that each such director is an independent director of the Company within the meaning of NASDAQNasdaq Listing Rule 5605(a)(2) and the related rules of the SEC. The Company’s independent directors conduct executive sessions at regularly scheduled meetings as required by NASDAQ Listing Rule 5605(b)(2). How can our stockholders communicate with the Board? Stockholders and others interested in communicating with the Board may do so by writing to Board of Directors, Live Ventures Incorporated, 325 EastE. Warm Springs Road, Suite 102, Las Vegas, Nevada 89119. What is the leadership structure of the Board? Mr. Jon Isaac, our President and Chief Executive Officer, also serves as Chairman of the Board. Currently, the Board does not have a Lead Independent Director. Although the Board assesses the appropriate leadership structure from time to time in light of internal and external events or developments and reserves the right to make changes in the future, it believes that the current structure, as described in this Proxy Statement, is appropriate at this time given the size and experience of the Board, as well as the background and experience of management.

What is the Board’s role in risk oversight? Our management is responsible for managing risk and bringing the most material risks facing the Company to the Board’s attention. The Board has oversight responsibility for the processes established to report and monitor material risks applicable to the Company. The Board also oversees the appropriate allocation of responsibility for risk oversight among the committees of the Board. The Audit Committee plays a central role in overseeing the integrity of the Company’s financial statements and reviewing and approving the performance of the Company’s internal audit function and independent accountants. The Corporate Governance and Nominating Committee considers risks related to succession planning and considers risk related to the attraction and retention of talent and risks related to the design of compensation programs and arrangements. The Compensation Committee monitors the design and administration 9

of the Company’s compensation programs to ensure that they incentivize strong individual and group performance and include appropriate safeguards to avoid unintended or excessive risk taking by Company employees. The Board does not believe that its process for risk oversight should affect its leadership structure (i.e., whether it may combine the Chairman and CEO roles in the future) because Board committees (comprised entirely of independent directors) play the central role in risk oversight. What committees has the Board established? The Board has an Audit Committee, a Compensation Committee, and a Corporate Governance and Nominating Committee, each of which is a separately-designatedseparately designated standing committee of the Board. Each committee has a charter. Audit Committee. The purpose of our Audit Committee is to assist ourthe Board of Directors in overseeing (i) the integrity of our Company’s accounting and financial reporting processes, the audits of our financial statements, as well as our systems of internal controls regarding finance, accounting, and legal compliance; (ii) our Company’s compliance with legal and regulatory requirements; (iii) the qualifications, independence and performance of our independent public accountants; and (iv) our Company’s financial risk; and (v) our Company’s internal audit function.risk. In carrying out this purpose, the Audit Committee maintains and facilitates free and open communication between the Board, the independent public accountants, and our management. During fiscal 2020, Messrs. Gao (Chairman), Butler, and Sickmeyer currently serveserved on our Audit Committee. Each member of the committee satisfies the independence standards specified in Rule 5605(a)(2) of the NASDAQNasdaq Listing Rules and the related rules of the SEC and has been determined by the Board to be “financially literate” with accounting or related financial management experience. The Board has also determined that Mr. Gao is an “audit committee financial expert” as defined under SEC rules and regulations and qualifies as a financially sophisticated audit committee member as required under Rule 5605(c)(2)(A) of the NASDAQNasdaq Listing Rules. The Board has adopted a charter for the Audit Committee, a copy of which is posted on our website at ir.livedeal.com/governance-documents.ir.liveventures.com/governance-docs. The Audit Committee met fiveeight times, either telephonically, or in person, or via Zoom, during fiscal 2017.2020. Compensation Committee. The purpose of the Compensation Committee is to (i) discharge the Board’s responsibilities relating to compensation of the Company’s directors and executives, (ii) produce an annual report on executive compensation for inclusion in the Company’s proxy statement, asif necessary, and (iii) oversee and advise the Board on the adoption of policies that govern the Company’s compensation programs, including stock and benefit plans. During fiscal 2017,2020, Messrs. Butler (Chairman), Gao, and Sickmeyer served on the Compensation Committee. Each member of the committee satisfies the independence standards specified in Rule 5605(a)(2) of the NASDAQNasdaq Listing Rules and the related rules of the SEC. In addition, each of the current members of the Compensation Committee is a “non-employee director” under Section 16 of the Exchange Act and an “outside director” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The Board has adopted a charter for the Compensation Committee, a copy of which is posted on our website at ir.livedeal.com/governance-documents.ir.liveventures.com/governance-docs. The Compensation Committee met threeacted two times either telephonically or in person,by unanimous written consent during fiscal 2017.2020. Corporate Governance and Nominating Committee.Committee. The purpose of the Corporate Governance and Nominating Committee is to (i) identify individuals who are qualified to become members of the Board, consistent with criteria approved by the Board, and to select, or to recommend that the Board select, the director nominees for the next annual meeting of stockholders or to fill vacancies on the board; (ii) develop and recommend to the Board a set of corporate governance principles applicable to our Company; and (iii) oversee the evaluation of the Board and our Company’s management. During fiscal 2017,2020, Messrs. Butler (Chairman), Gao, and Sickmeyer served on the Corporate Governance and Nominating Committee. Each member of the committee satisfies the independence standards specified in Rule 5605(a)(2) of the NASDAQNasdaq Listing Rules and the related rules of the SEC. The Board has adopted a charter for the Corporate Governance and Nominating Committee, a copy of which is posted on our website at ir.livedeal.com/governance-documents.ir.liveventures.com/governance-docs. The Corporate Governance and Nominating Committee metacted one time by unanimous written consent during fiscal 2017. 2020. What are the procedures of the Corporate Governance and Nominating Committee in making nominations? The Corporate Governance and Nominating Committee establishes and periodically reviews the criteria and qualifications for board membership and the selection of candidates to serve as directors of our Company. In determining whether to nominate a candidate for director, the Corporate Governance and Nominating Committee considers the following criteria, among others: 10 | · | the candidate’s integrity and ethical character; |

the candidate’s integrity and ethical character; | · | whether the candidate is “independent” under applicable SEC and NASDAQ rules and regulations; |

| · | whether the candidate has any conflicts of interest that would materially impair his or her ability to exercise independent judgment as a member of the Board or otherwise discharge the fiduciary duties owed by a director to Live Ventures and our stockholders; and |

| · | the candidate’s ability to represent all of our stockholders without favoring any particular stockholder group or other constituency of Live Ventures. |

whether the candidate is “independent” under applicable SEC and NASDAQ rules and regulations; whether the candidate has any conflicts of interest that would materially impair his or her ability to exercise independent judgment as a member of the Board or otherwise discharge the fiduciary duties owed by a director to Live Ventures and our stockholders; and the candidate’s ability to represent all of our stockholders without favoring any particular stockholder group or other constituency of Live Ventures. The committee has the authority to retain a search firm to identify director candidates and to approve any fees and retention terms of the search firm’s engagement, although the committee has not recently engaged such a firm. Although the committee has not specified any minimum criteria or qualifications that each director must meet, the committee conducts its nominating process in a manner designed to ensure that the Board continues to meet applicable requirements under SEC and NASDAQNasdaq rules (including, without limitation, as they relate to the composition of the Audit Committee). The Board is of the view that the continuing service of qualified incumbents promotes stability and continuity in the boardroom, giving our Company the benefit of the familiarity and insight into our Company’s affairs that its directors have accumulated during their tenure, while contributing to the Board’s ability to work as a collective body. Accordingly, the process of the Corporate Governance and Nominating Committee for identifying nominees reflects the practice of re-nominating incumbent directors who continue to satisfy the committee’s criteria for membership on the Board, who the committee believes will continue to make important contributions to the Board, and who consent to continue their service on the Board. What are our policies and procedures with respect to director candidates who are nominated by security holders? The Corporate Governance and Nominating Committee will consider director candidates recommended by our stockholders under criteria similar to those used to evaluate candidates nominated by the committee (including those listed above). In considering the potential candidacy of persons recommended by stockholders, however, the committee may also consider the size, duration, and any special interest of the recommending stockholder (or group of stockholders) in Live Ventures’ common stock. Stockholders who desire to recommend a nominee for election to the Board must follow the following procedures: Recommendations must be submitted to the Company in writing, addressed to our Principal Financial Officer at the Company’s principal headquarters. | · | Recommendations must be submitted to the Company in writing, addressed to our Principal Financial Officer at the Company’s principal headquarters. |

| · | Recommendations must include all information reasonably deemed by the recommending stockholder to be relevant to the committee’s consideration, including (at a minimum): |

| · | the name, address and telephone number of the potential candidate; |

| · | the number of shares of Live Ventures’ common stock owned by the recommending stockholder (or group of stockholders), and the time period for which such shares have been held; |

| · | if the recommending stockholder is not a stockholder of record according to the books and records of the Company, a statement from the record holder of the shares (usually a broker or bank) verifying the holdings of the stockholder; |

| · | a statement from the recommending stockholder as to whether s/he has a good faith intention to continue to hold the reported shares through the date of Live Ventures’ next annual meeting (at which the candidate would be elected to the Board); |

| · | with respect to the recommended nominee: |

| · | the information required by Item 401 of Regulation S-K (generally providing for disclosure of the name, address, any arrangements or understandings regarding the nomination and the five-year business experience of the proposed nominee, as well as information about the types of legal proceedings within the past five years involving the nominee); |

| · | the information required by Item 404 of Regulation S-K (generally providing for disclosure of transactions in which Live Ventures l was or is to be a participant involving more than $120,000 and in which the nominee had or will have any direct or indirect material interest and certain other types of business relationships with Live Ventures); |

| · | a description of all relationships between the proposed nominee and the recommending stockholder and any arrangements or understandings between the recommending stockholder and the nominee regarding the nomination; |

Recommendations must include all information reasonably deemed by the recommending stockholder to be relevant to the committee’s consideration, including (at a minimum): the name, address and telephone number of the potential candidate; | · | a description of all relationships between the proposed nominee and any of Live Ventures’ competitors, customers, suppliers, labor unions or other persons with special interests regarding Live Ventures; |

the number of shares of Live Ventures’ common stock owned by the recommending stockholder (or group of stockholders), and the time period for which such shares have been held; | · | a description of the contributions that the nominee would be expected to make to the Board and the governance of Live Ventures; and |

if the recommending stockholder is not a stockholder of record according to the books and records of the Company, a statement from the record holder of the shares (usually a broker or bank) verifying the holdings of the stockholder; | · | a statement as to whether, in the view of the stockholder, the nominee, if elected, would represent all stockholders and not serve for the purpose of advancing or favoring any particular stockholder or other constituency of Live Ventures. |

a statement from the recommending stockholder as to whether s/he has a good faith intention to continue to hold the reported shares through the date of Live Ventures’ next annual meeting (at which the candidate would be elected to the Board); | · | The nominating recommendation must be accompanied by the consent of the proposed nominee to be interviewed by the Corporate Governance and Nominating Committee and other Board members and, if elected, to serve as a director of Live Ventures. |

with respect to the recommended nominee: | · | A stockholder nomination must be received by Live Ventures, as provided above, not later than 120 calendar days prior to the first anniversary of the mailing date of the proxy statement for the prior annual meeting. |

the information required by Item 401 of Regulation S-K (generally providing for disclosure of the name, address, any arrangements or understandings regarding the nomination and the five-year business experience of the proposed nominee, as well as information about the types of legal proceedings within the past five years involving the nominee); | · | If a recommendation is submitted by a group of two or more stockholders, the information regarding the recommending stockholders must be submitted with respect to each stockholder in the group (as the term group is defined under SEC regulations). |

11

the information required by Item 404 of Regulation S-K (generally providing for disclosure of transactions in which Live Ventures was or is to be a participant involving more than $120,000 and in which the nominee had or will have any direct or indirect material interest and certain other types of business relationships with Live Ventures); a description of all relationships between the proposed nominee and the recommending stockholder and any arrangements or understandings between the recommending stockholder and the nominee regarding the nomination; a description of all relationships between the proposed nominee and any of Live Ventures’ competitors, customers, suppliers, labor unions or other persons with special interests regarding Live Ventures; a description of the contributions that the nominee would be expected to make to the Board and the governance of Live Ventures; and a statement as to whether, in the view of the stockholder, the nominee, if elected, would represent all stockholders and not serve for the purpose of advancing or favoring any particular stockholder or other constituency of Live Ventures. The nominating recommendation must be accompanied by the consent of the proposed nominee to be interviewed by the Corporate Governance and Nominating Committee and other Board members and, if elected, to serve as a director of Live Ventures. A stockholder nomination must be received by Live Ventures, as provided above, not later than 120 calendar days prior to the first anniversary of the mailing date of the proxy statement for the prior annual meeting. If a recommendation is submitted by a group of two or more stockholders, the information regarding the recommending stockholders must be submitted with respect to each stockholder in the group (as the term group is defined under SEC regulations). Does the Board have a policy on director attendance at the Annual Meeting? The Board does not have a formal policy regarding director attendance at the Company’s annual meeting of stockholders, but all directors are encouraged to attend. AllFour of our directors who were standing for re-election at our 20172020 Annual Meeting attended that meeting, either in person or via teleconference. All directors standing for re-election this year anticipate attending the Annual Meeting, either in person or via teleconference. How are our directors compensated? Jon Isaac, who is aboth director and also an employee of the Company does not receive any separate compensation in connection with his Board service. Our non-employee directors generally receive a $25,000$30,000 annual retainer, although we make different arrangements with certain of our non-employee directors from time to time. Our committee chairpersons generally receive an additional annual retainer (equal to $10,000 for the Lead Director and Audit Committee Chairman, and $5,000 for the chairpersons of the other committees). In the event that the Chairman of the Board is a non-employee director, we also pay such person an additional retainer. We reimburse directors for reasonable expenses related to their Board service. For more information about the compensation paid or provided to our directors during fiscal 2017,2020, please refer to the “Director Compensation” section of this Proxy Statement. Does the Company have a Code of Ethics? We have adopted a Code of Business Conduct and Ethics that applies to all directors, officers and employees of our Company, including the Chief Executive Officer and other principal financial and operating officers of the Company. The Code of Business Conduct and Ethics is posted on our website at ir.live-ventures.com/governance-documents.ir.liveventures.com/governance-docs. If we make any amendment to, or grant any waivers of, a provision of the Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller where such amendment or waiver is required to be disclosed under applicable SEC rules, we intend to disclose such amendment or waiver and the reasons therefor on Form 8-K or on our website. 12

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors, certain of our officers and persons who own at least 10% of a registered class of our equity securities to file reports of ownership and changes in ownership with the SEC.

Based solely on our review of copies of such reports and written representations from our executive officers and directors, we believe that our executive officers and directors complied with all Section 16(a) filing requirements during the fiscal year ended September 30, 2017.

RELATED PARTY TRANSACTIONS Mezzanine Loan from Isaac Capital Fund

In connection with the purchase of Marquis Industries Inc., the Company entered into a mezzanine loan in an amount of up to $7,000,000 provided by Isaac Capital Fund, a private lender whose managing member is Jon Isaac, the chief executive officer of the Company.

The Isaac Capital Fund mezzanine loan bears interest at 12.5% with payment obligations of interest each month and all principal due in January 2021 (six months after the final payments are due under the Bank of America Term and Revolving Loan). As of September 30, 2017, there was $2,000,000 outstanding on this mezzanine loan.

ICG Note and Warrants

On January 23, 2014, the Company issued a note to Isaac Capital Group (“ICG”), a related party, in the principal amount of $500,000. Because the conversion price of $13.74 was less than the stock price, this gave rise to a beneficial conversion feature valued at $500,000. The Company recognized this beneficial conversion feature as a debt discount and additional paid in capital. The debt discount is being amortized over the one-year term. On December 3, 2014, ICG converted the note into 112,395 shares of common stock, therefore the remaining debt discount of $158,219 was written off and recognized as interest expense. In addition, upon the conversion of note, the Company issued to ICG a warrant to acquire 112,395 additional shares of the Company’s common stock at an exercise price of $5.70 per share. The fair value of the warrants issued in connection with the conversion of note was $1,853,473 and was immediately recognized as interest expense. Memorializing a transaction that was approved in August 2017, on January 16, 2018, we entered into an amendment to warrantsTransactions with Isaac Capital Group LLC which amends

On April 9, 2020, the expirationCompany entered into and delivered to ICG an unsecured revolving line of credit promissory note whereby the Lender agreed to provide the Company with a $1,000,000 revolving credit facility (the “Unsecured Revolving Credit Facility”). The Unsecured Revolving Credit Facility matures on April 8, 2023, bears interest at 10.0% per annum, and provides for the payment of interest monthly in arrears. As of the date of certain warrants issued to Isaac Capital Group, LLC to provide that ifthis proxy statement, the specified warrant remains unexercisedCompany has not drawn on the expiration date, thenUnsecured Revolving Credit Facility. On July 10, 2020, Live Ventures borrowed $2.0 million (the “ICG Loan”) from ICG. The ICG Loan matures on May 1, 2025 and bears interest at a rate of 12.5% per annum. Interest is payable in arrears on the expiration date shall be automatically extendedlast day of each month, commencing July 31, 2020. Live Ventures used the proceeds from the ICG Loan to finance the acquisition of Precision Marshall. The ICG Loan documents contain events of default and other provisions customary for a periodloan of two years from such date.this type. Jon Isaac, Live Ventures’ President and Chief Executive Officer, is the President and sole member of ICG. As of June 10, 2021, Mr. Isaac is the beneficial owner of approximately 53.0% of the outstanding capital stock (on an as-converted and as-exercised basis) of Live Ventures, which percentage includes ICG’s beneficial ownership of approximately 45.5% of the outstanding capital stock (on an as-converted and as-exercised basis) of Live Ventures. Loan from Spriggs Investments LLC On July 10, 2020, Live Ventures executed a promissory note (the “Spriggs Promissory Note”) in favor of Spriggs Investments LLC (“Spriggs Investments”), a limited liability company whose sole member is Rodney Spriggs, the President and Chief Executive Officer of Vintage Stock, Inc., a wholly-owned subsidiary of Live Ventures, that memorializes a loan by Spriggs Investments to Live Ventures in the initial principal amount of $2.0 million (the “Spriggs Loan”). The Spriggs Loan matures on July 10, 2022 and bears simple interest at a rate of 10.0% per annum. Interest is payable in arrears on the last day of each month, commencing July 31, 2020. Live Ventures may prepay the Spriggs Loan in whole or in part at any time or from time to time without penalty or premium by paying the principal amount to be prepaid, together with accrued interest thereon to the date of prepayment. Live Ventures used the proceeds from the Spriggs Loan to finance the acquisition of Precision Marshall. The Spriggs Promissory Note contains events of default and other provisions customary for a loan of this type. The Spriggs Loan was guaranteed personally by Jon Isaac, Live Ventures’ President and Chief Executive Officer, and by ICG. As of June 10, 2021, Mr. Spriggs is a record and beneficial owner of less than 1.0% of the outstanding capital stock of Live Ventures. Acquisition of ApplianceSmart, Inc. On December 30, 2017, ApplianceSmart Holdings Inc. (“ASH”) entered into a Stock Purchase Agreement (the “Agreement”) with Appliance Recycling Centers of America, Inc. (now JanOne Inc.) (the “Seller”) and ApplianceSmart, Inc. (“ApplianceSmart”), a subsidiary of the Seller. Pursuant to the Agreement, ASH purchased (the “Transaction”) from the Seller all of the issued and outstanding shares of capital stock of ApplianceSmart in exchange for $6,500,000 (the “Purchase Price”). ASH was required to deliver the Purchase Price, and a portion of the Purchase Price was delivered, to the Seller prior to March 31, 2018. Between March 31, 2018 and April 24, 2018, ASH and the Seller negotiated in good faith the method of payment of the remaining outstanding balance of the Purchase Price. On April 25, 2018, ASH delivered to the Seller that certain Promissory Note (the “ApplianceSmart Note”) in the original principal amount of $3,919,000, (the “Original Principal Amount”), as such amount may be adjusted per the terms of the ApplianceSmart Note. The ApplianceSmart Note is effective as of April 1, 2018 and matures on April 1, 2021 (the “Maturity Date”). The ApplianceSmart Note bears interest at 5% per annum with interest payable monthly in arrears. Ten percent of the outstanding principal amount will be repaid annually on a quarterly basis, with the accrued and unpaid principal due on the Maturity Date. ApplianceSmart has agreed to guaranty repayment of the ApplianceSmart Note. The remaining $2,581,000 of the Purchase Price was paid in cash by ASH to the Seller. ASH may reborrow funds, and pay interest on such re-borrowings, from the Seller up to the Original Principal Amount. As 13

of September 30, 2020, there was $2,826,000 outstanding on the ApplianceSmart Note and is included in Debtor in possession liabilities on the Company’s Consolidated Balance Sheet. On December 26, 2018, ASH and the Seller amended and restated the ApplianceSmart Note to, among other things, grant the Seller a security interest in the assets of ASH and ApplianceSmart in accordance with the terms of separate security agreements entered into between ASH and ApplianceSmart, respectively, and the Seller. On December 9, 2019, ApplianceSmart filed a voluntary petition (the “Chapter 11 Case”) in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”) seeking relief under Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”). The bankruptcy affects Live Ventures’ indirect subsidiary ApplianceSmart only and does not affect any other subsidiary of Live Ventures, or Live Ventures itself. ApplianceSmart expects to continue to operate its business in the ordinary course of business as debtor-in-possession under the jurisdiction of the Bankruptcy Court and in accordance with applicable provisions of the Bankruptcy Code and the orders of the Bankruptcy Court. In addition, the Company reserves its right to file a motion seeking authority to use cash collateral of the lenders under the reserve-based revolving credit facility. The case is being administrated under the caption In re: ApplianceSmart, Inc. (case number 19-13887). Court filings and other information related to the Chapter 11 Case are available at the PACER Case Locator website for those registered to do so or at the Courthouse located at One Bowling Green, Manhattan, New York 10004. Sale of ApplianceSmart Contracting On April 22, 2020, the Company sold ApplianceSmart Contracting Inc. (“ApplianceSmart Contracting”) to Michelle Cooper, a related party as a result of her relationship with Virland A. Johnson, the Company’s Chief Financial Officer, for $60,000. In connection with the sale, and under the terms of a purchase and sale agreement and a secured promissory note (the “ASC Note”), the Company agreed to loan ApplianceSmart Contracting up to approximately $382,000 to satisfy then outstanding sales tax obligations owed by ApplianceSmart Contracting. Advances under the loan are only made by the Company to ApplianceSmart Contracting upon the presentation of evidence by ApplianceSmart Contracting of the satisfaction of one or more outstanding state sales tax amounts. Advances bear interest at 8.0% per annum. The loan matures on September 30, 2022 or on such earlier date as provided in the Note. The loan is guaranteed by the related party and secured by the assets of ApplianceSmart Contracting. At the closing of the sale transaction, the Company advanced ApplianceSmart Contracting $60,000. Customer Connexx Customer Connexx LLC, a wholly owned subsidiary of JanOne Inc. (formerly Appliance Recycling Centers of America, Inc.), sub-leases call center space from Live Ventures Incorporated in Las Vegas, Nevada. Total amount of sub-lease rent and common area charges was $164,516approximately $182,000 for fiscal year ended September 30, 2017.2020. ProceduresProcedures for Approval of Related Party Transactions

In accordance with its charter, the Audit Committee reviews and recommends for approval all related party transactions (as such term is defined for purposes of Item 404 of Regulation S-K). The Audit Committee participated in the approval of the transactions described above.above other than the ApplianceSmart Acquisition, which was approved by a special committee consisting solely of Mr. Sickmeyer. 14

AUDIT COMMITTEECOMMITTEE REPORT The Audit Committee operates pursuant to a charter which is reviewed annually by the Audit Committee. Additionally, a brief description of the primary responsibilities of the Audit Committee is included in this Proxy Statement under the discussion of “The Board of Directors and Certain Governance Matters — Committee Membership — Audit Committee.” Under the Audit Committee charter, management is responsible for the preparation, presentation and integrity of the Company’s financial statements, the application of accounting and financial reporting principles and our internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm is responsible for auditing our financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States of America. In the performance of its oversight function, the Audit Committee reviewed and discussed the audited financial statements and internal control over financial reporting of the Company with management and with the independent registered public accounting firm. The Audit Committee also discussed with the independent registered public accounting firm the matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard No. 1301 “Communications with Audit Committee.” In addition, the Audit Committee received the written disclosures and the letters from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence and discussed with the independent registered public accounting firm their independence. Based upon the review and discussions described in the preceding paragraph, the Audit Committee recommended to the Board that the audited financial statements of the Company be included in its Annual Report on Form 10-K for the fiscal year ended September 30, 2017, as amended,2020, filed with the SEC. | The Audit Committee | | Dennis (De) Gao, Chairman | | Richard D. Butler, Jr. | | Tyler Sickmeyer |

15

COMPENSATION DISCUSSION AND ANALYSIS Overview The purpose of this Compensation Discussion and Analysis (“CD&A”) is to provide material information about the Company’s compensation philosophy, objectives, and other relevant policies and to explain and put into context the material elements of the disclosure that follows in this Form 10-KProxy Statement with respect to the compensation of our named executive officers (in this CD&A, referred to as the “NEOs”). For fiscal 2017,2020, our NEOs were: Jon Isaac, President and Chief Executive Officer Tim Bailey,Weston A. Godfrey, Jr., Chief Executive Officer of Marquis Industries, Inc.

Rodney Spriggs,Michael J. Stein, Senior Vice President and Chief Executive Officer of Vintage StockGeneral Counsel